In other words, evaluate your records to your financial institution steadiness to make sure every thing matches. This process helps spot errors early, like missed transactions or duplicate entries and may stop small discrepancies from turning into larger issues. For occasion, when you make a purchase on credit score or take out a loan, you credit your legal responsibility account as a end result of you’re including to your financial obligations. Most modern bookkeeping and accounting software program, like QuickBooks Online, mechanically facilitates double-entry accounting. So, you only have to enter a transaction once, and the software automatically creates the corresponding debit or credit for you. For example, when paying hire for your firm’s office each month, you would enter a credit score in your legal responsibility account.

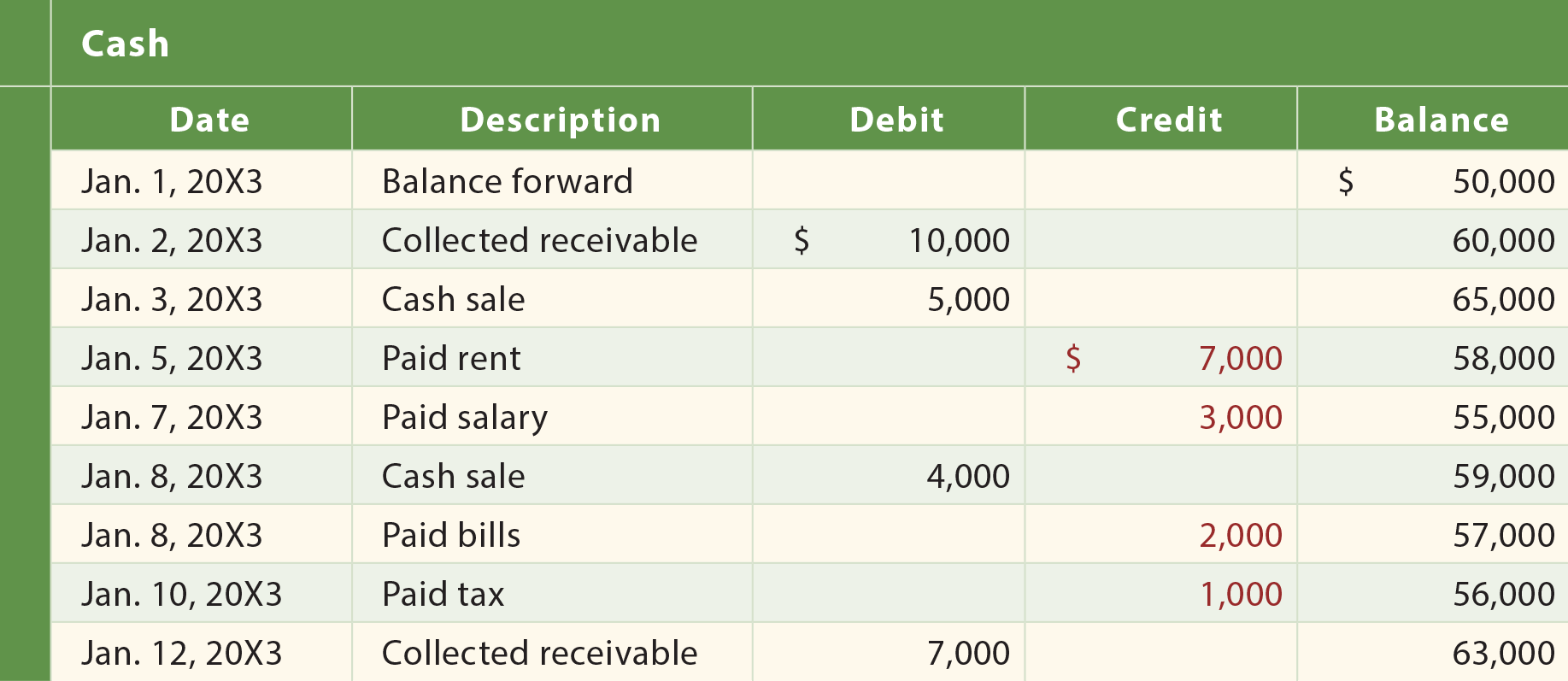

As acknowledged earlier, every ledger account has a debit aspect and a credit score aspect. Now the query is that on which aspect the rise or decrease in an account is to be recorded. The answer lies within the studying of regular balances of accounts and the rules of debit and credit score. A debit is an entry recorded on the left facet of an account, sometimes growing property or bills and lowering liabilities, fairness, or revenue. A credit score is an entry recorded on the best aspect of an account, normally rising liabilities, equity, or income and lowering belongings or expenses. For every debit, there should be an equal credit, ensuring that complete debits at all times equal total credit, maintaining the integrity of the monetary information.

Tips On How To Remember Debits And Credit

As a business owner, you must acknowledge the accounting fundamental terminology, debit and credit score, precisely to know your company’s transactions without any issue. The reasoning behind this rule is that revenues improve retained earnings, and will increase in retained earnings are recorded on the best facet. Expenses decrease retained earnings, and decreases in retained earnings are recorded on the left facet. This is decided by the world of the balance sheet you’re working from. For example, debit increases the steadiness of the asset facet of the steadiness sheet.

There can additionally be https://www.simple-accounting.org/ a distinction in how they present up in your books and monetary statements. Credit Score balances go to the best of a journal entry, with debit balances going to the left. A debit in an accounting entry will lower an equity or legal responsibility account. CR is a notation for “credit,” and DR is a notation for “debit” in double-entry accounting. A debit entry to an equity account will increase the stability of the account, whereas a credit entry decreases the stability.

The Importance Of Debits And Credits

This balancing act supplies a transparent and accurate illustration of a business’s financial place and efficiency. Fostering this understanding is critical for entrepreneurs who want to maintain optimized and transparent financial practices. Tax accounting services rely closely on correct debit and credit score entries to ensure proper tax reporting and compliance. Assets equal liabilities plus shareholders’ fairness on a steadiness sheet or in a ledger using Pacioli’s technique of bookkeeping or double-entry accounting. An increase within the value of assets is a debit to the account, and a decrease is a credit score. All accounts that normally contain a credit score stability will increase in quantity when a credit (right column) is added to them, and decreased when a debit (left column) is added to them.

- It can also assist you to reconcile your financial institution accounts, generate monetary reviews, and maintain monitor of expenses without all of the guide work.

- A listing of the accounts available within the accounting system in which to record entries.

- Journal entries are normally step one of an accounting cycle.

So, you are taking out a bank loan payable to the tune of $1,000 to purchase the furniture. At FreshBooks, we assist you to protect your income and time with a powerful bookkeeping service. By integrating with Bench, we assist you to observe every dollar you spend while Bench handles bookkeeping and tax preparation. With us, you’ll know your corporation so you’ll have the ability to grow your small business. Using credit is different as a end result of it means you exceed the finances out there to your small business.

Bank’s Debits And Credits

When the corporate repays the bank mortgage, the Cash account and the Notes Payable account are also concerned. An adjusting journal entry is a core principle of accrual accounting. You make this special entry at the finish of a interval (like a month, quarter, or year) to evaluate how profitable you were throughout that time. The transaction is now perfectly balanced, showing the business has a brand new asset (cash) and an equal claim from the proprietor (equity). Asset accounts monitor useful sources your organization owns, similar to cash, accounts receivable, stock, and property.

Debits and credits are the key to the double-entry accounting system. For it to work, you need a debit and a credit for each transaction. This retains your books organized and your monetary statements accurate. To wrap it up, debits and credit are the constructing blocks of accounting. Being conversant in their nature and classification is crucial to make sense of each transaction that happens on your financial statements. Posting the debits and credits accurately is critical to keep your financial accounts balanced and to take care of the data for future reference.

When discussing credits and debits, we need to be completely sure we perceive what we’re doing to what facet of the accounting equation. An account with a balance that is the opposite of the traditional steadiness. For example, Accrued Depreciation is a contra asset account, as a end result of its credit steadiness is contra to the debit stability for an asset account. This is an owner’s equity account and as such you’ll anticipate a credit balance. Different examples embody (1) the allowance for doubtful accounts, (2) low cost on bonds payable, (3) gross sales returns and allowances, and (4) gross sales discounts.

Insurance Expense, Wages Expense, Promoting Expense, Curiosity Expense are bills matched with the time period within the heading of the revenue statement. Underneath the accrual foundation of accounting, the matching is NOT based mostly on the date that the expenses are paid. Since money was paid out, the asset account Money is credited and another account needs to be debited. As A Outcome Of the lease payment shall be used up within the present period (the month of June) it is considered to be an expense, and Lease Expense is debited. If the fee was made on June 1 for a future month (for instance, July) the debit would go to the asset account Pay As You Go Rent. Revenues and features are recorded in accounts similar to Gross Sales, Service Revenues, Curiosity Revenues (or Curiosity Income), and Acquire on Sale of Property.

These are only a few examples of financial transactions that occur in an organization. There are quite a few transactions happening in companies daily however the underlying idea for each transaction is similar. These are principally examples of regular accounts, however, there are also contra-accounts that are handled the precise opposite of normal accounts. Let’s first have a glance at the traditional balances of accounts and then learn the way the rules of debit and credit score are utilized to report transactions in journal. In this kind, will increase to the amount of accounts on the left-hand facet of the equation are recorded as debits, and decreases as credit. Conversely for accounts on the right-hand side, increases to the amount of accounts are recorded as credit to the account, and reduces as debits.